Explain the Main Differences Between Regressive and Progressive Tax Systems

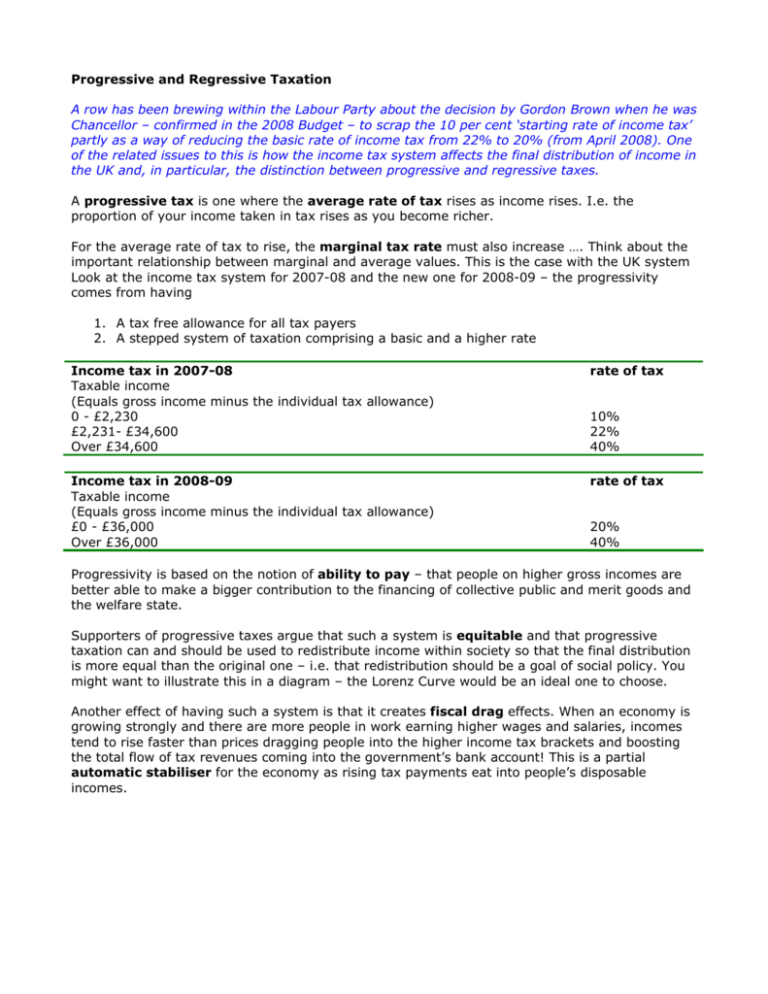

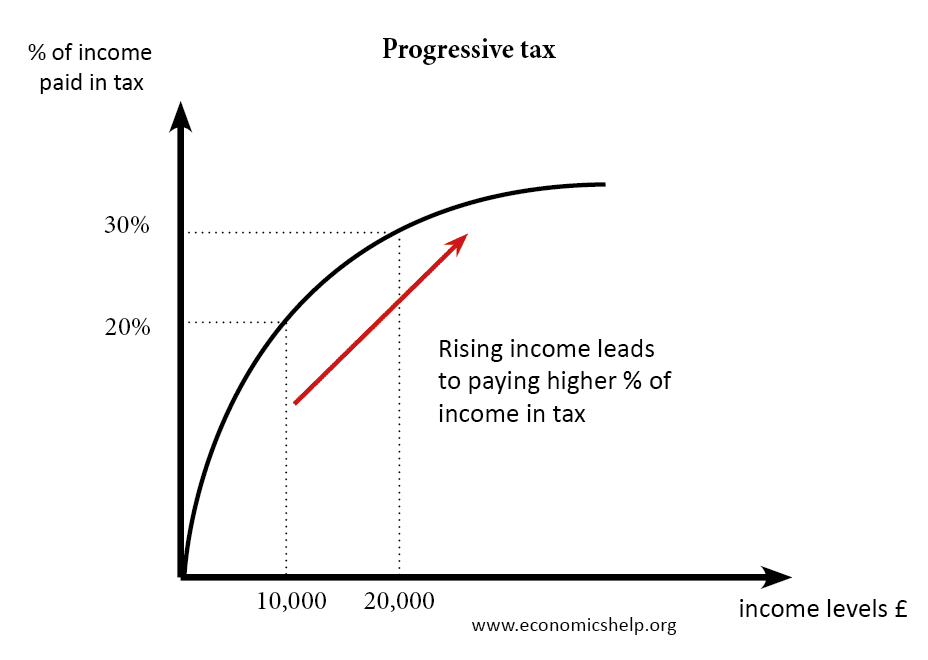

Progressive taxes increase based on your taxable income. A progressive tax system is when your income increases so does your taxes.

Describe The Differences Between A Regressive And Progressive Tax Provide Some Examples Of Each In Canada Intermediate Canadian Tax

Two of these systems impact high- and low-income earners differently.

. A regressive tax system is where the lower class of people pay a bigger portion of income tax than higher class. A regressive tax system is where the lower class of people pay a bigger portion of income tax than higher class. It is a direct tax because the money goes directly to the government.

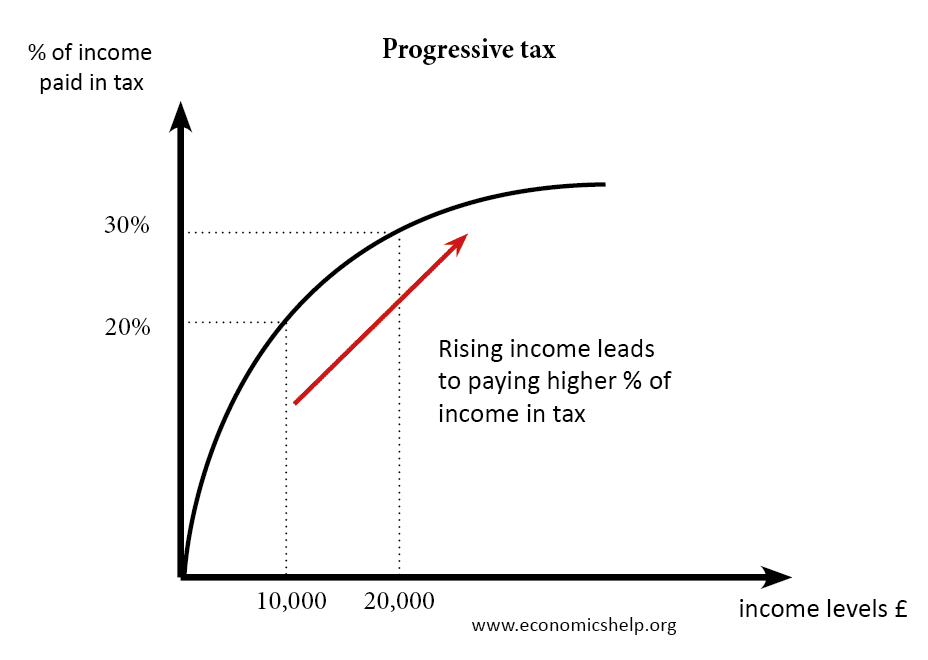

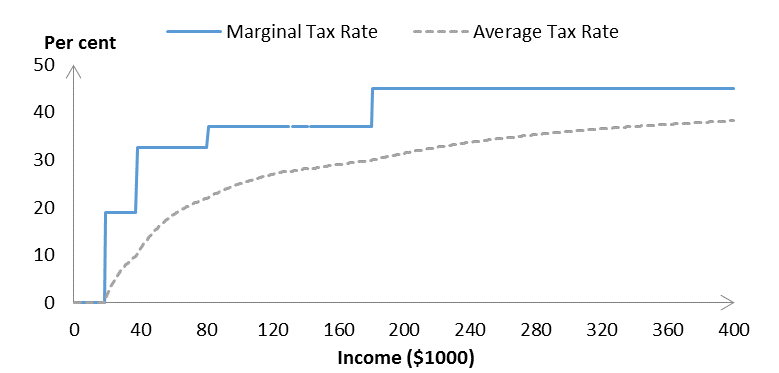

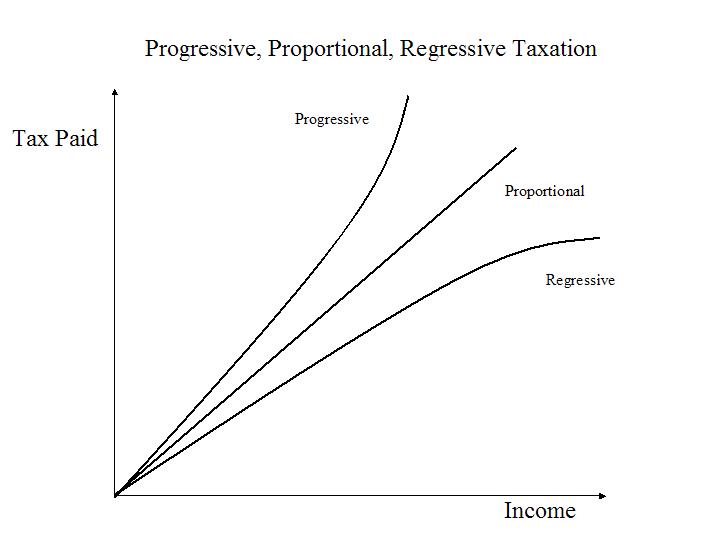

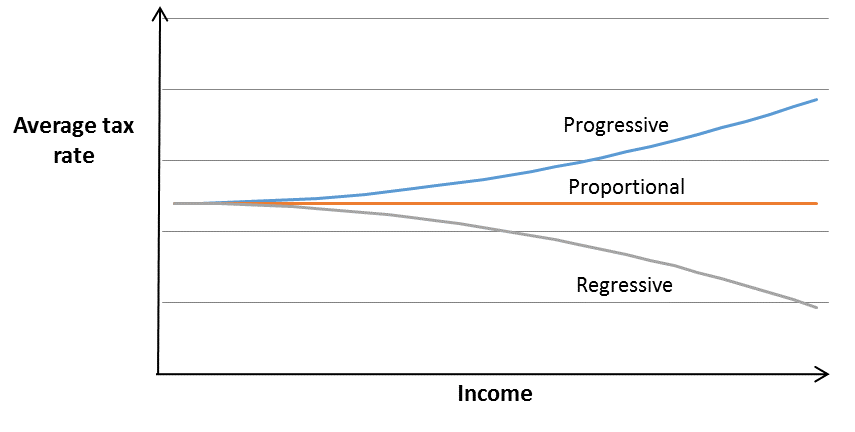

Regressive taxes have a greater impact on low-income individuals than they do on high-income earners. Progressive Tax Systems A progressive tax system means the proportion of income paid in taxes increases as the taxpayers income increases. The proportional tax rate has a constant slope graphically while the progressive tax rate has a rising positive slope.

A look at how the numbers work in these tax schemes helps illustrate the concepts of progressive and regressive taxes. What is the difference between a progressive tax and regressive tax. The main differences between a flat regressive and progressive tax plans is that the flat tax you pay the same amount even if the price of the good increases applies for everybody a regressive tax is the one that decreases if the amount of money you make increases and the progressive tax is when the tax increases if the amount of money you make.

That is as income or general wealth. Regressive taxA tax that takes a larger percentage of income from low. In a progressive tax the more you earn the higher your tax rateIn a regressive tax the less you earn the higher your tax rateThe classical progressive tax.

The next two tabs illustrate progressive and regressive taxation schemes. A flat-tax systems is where the same tax rate is applied to everyone. A tax is called Degressive when the rate of progression in taxation does not increase in the same proportion as the income increases.

Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability-to-pay as such taxes shift the incidence increasingly to those with a higher ability-to-pay. Regressive proportional and progressive. Regressive proportional and progressive.

A regressive tax system is where the lower class of people pay a bigger portion of income tax than the higher class. A regressive tax takes a smaller percentage of peoples income the larger their income is. The steeper the negative slope of the tax line the more regressive the taxation.

The regressive tax rate line has a declining negative slope. In progressive tax marginal tax rate is greater than the average tax rate. Then we examine a hypothetical example of sales taxes paid on a flat screen television set.

Progressive and regressive taxation system are very different from each other. A progressive tax system takes into account ability to pay setting rates based on income. In progressive tax system the assessees ability to pay is considered.

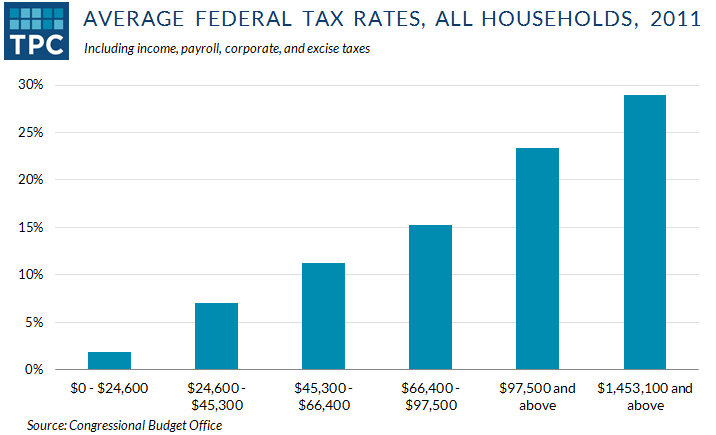

A regressive tax results in a larger percentage of your income being taxed. Therefore high-income taxpayers pay a progressively higher percentage of tax than low-income taxpayers. A flat-tax systems is where the same tax rate is applied to everyone.

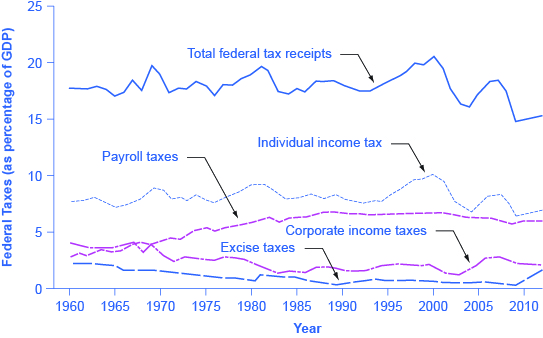

Tax systems in the US. Fall into three main categories. A progressive tax system refers to the tax system where the tax rate to be paid increases with the increase in the income.

Lastly a flat tax system is where the same tax rate is applied to everyone no matter the class. Progressive taxes require those with higher incomes to pay a higher percentage of their income on those particular taxes. A progressive tax system is a proportional relationship between your income and taxes.

A the current federal personal income tax system b a local 25 income tax and c the current FICA social security tax system. As against this in the case of a regressive tax. Progressive taxes are the opposite of regressive taxes.

Progressive tax is that system of taxation in which rate of tax increases with increase in income but in case of regressive taxation rate of tax decreases with increase in income. A progressive tax charges a higher percentage the higher your income rises. A progressive tax system is when your income increases so does your taxes.

The opposite of a progressive tax is a regressive tax where the relative tax rate or burden increases as an individuals ability to pay it decreases. The main differences between progressive and regressive tax system are as follow. The difference between progressive regressive and proportional tax systems lies in how the government assesses a taxpayers tax liability or obligation.

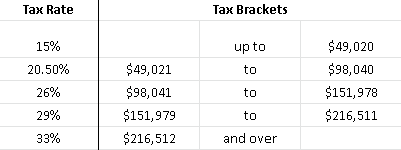

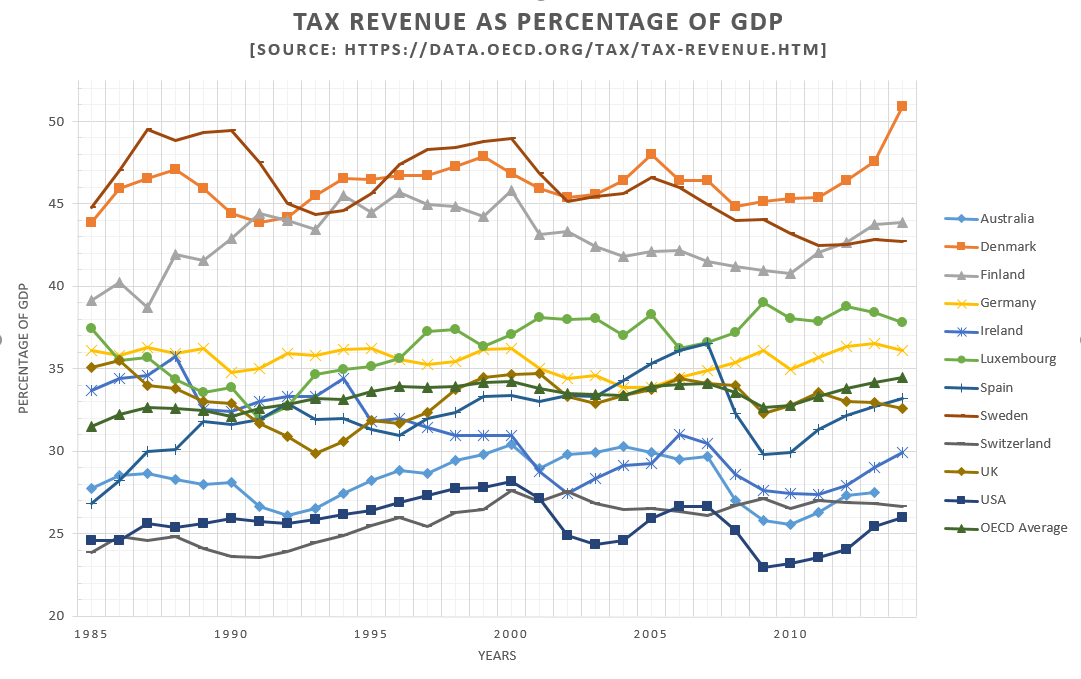

Explain the difference between a progressive tax system a regressive tax system and a proportional tax system. A progressive tax system is a proportional relationship between your income and taxes. Canada has a progressive income tax system.

Unlike regressive tax wherein the tax payers level of income does not matter at all. Progressive taxA tax that takes a larger percentage of income from high-income groups than from low-income groups. Tax systems fall into three main categories.

Two of these systems. Regressive tax is one in which the rate of taxation decreases as the taxpayers income increases. Most income tax schemes are progressive because they usually rely on graduated rates which increase the.

An example of this is the Federal income tax. A progressive tax is simply one approach to determining who pays what amount in their taxes. An example is state sales tax where everyone pays the same tax rate regardless of their income.

A regressive tax system is where the lower class of people pay a bigger portion of income tax than the higher class. A regressive tax is the exact opposite. In contrast to it regressive tax system is the arrangement where the tax to be paid is uniform in nature.

An example of this is the social security tax. Progressive taxes increase based on your taxable income. A proportional tax also referred to as a flat tax impacts low- middle- and high-income earners relatively equally.

The steeper the slope of the tax line the progressive the tax regime. Proportional taxA tax that takes the same percentage of income from all income groups. Higher-income taxpayers pay a smaller percentage of their income than lower-income taxpayers because the tax is not based on ability to pay.

Most state income taxes have a similar progressive structure. Lastly a flat tax system is where the same tax rate is applied to everyone no matter the class. Progressive tax includes all direct taxes while regressive tax covers all indirect taxes.

In other words as your income increases so does your tax amount. In other words as your income increases so does your tax amount. Answer 1 of 5.

First we review the federal income tax rates for 2005. Decide which of these tax structures is represented by. They require those with lower incomes to pay a higher percentage of their income on such taxes.

The impact of regressive taxes is exactly the opposite. It isnt about initiating reform but rather an attempt to ensure taxation is fair to all payers.

Inflation Bundle Learning Objectives Economics Lesson

Choose Your Tax System Progressive Vs Regressive Tax Policy Center

Brief Progressive And Regressive Taxes Austaxpolicy The Tax And Transfer Policy Blog

What S The Difference Between Progressive And Regressive Taxes Youtube

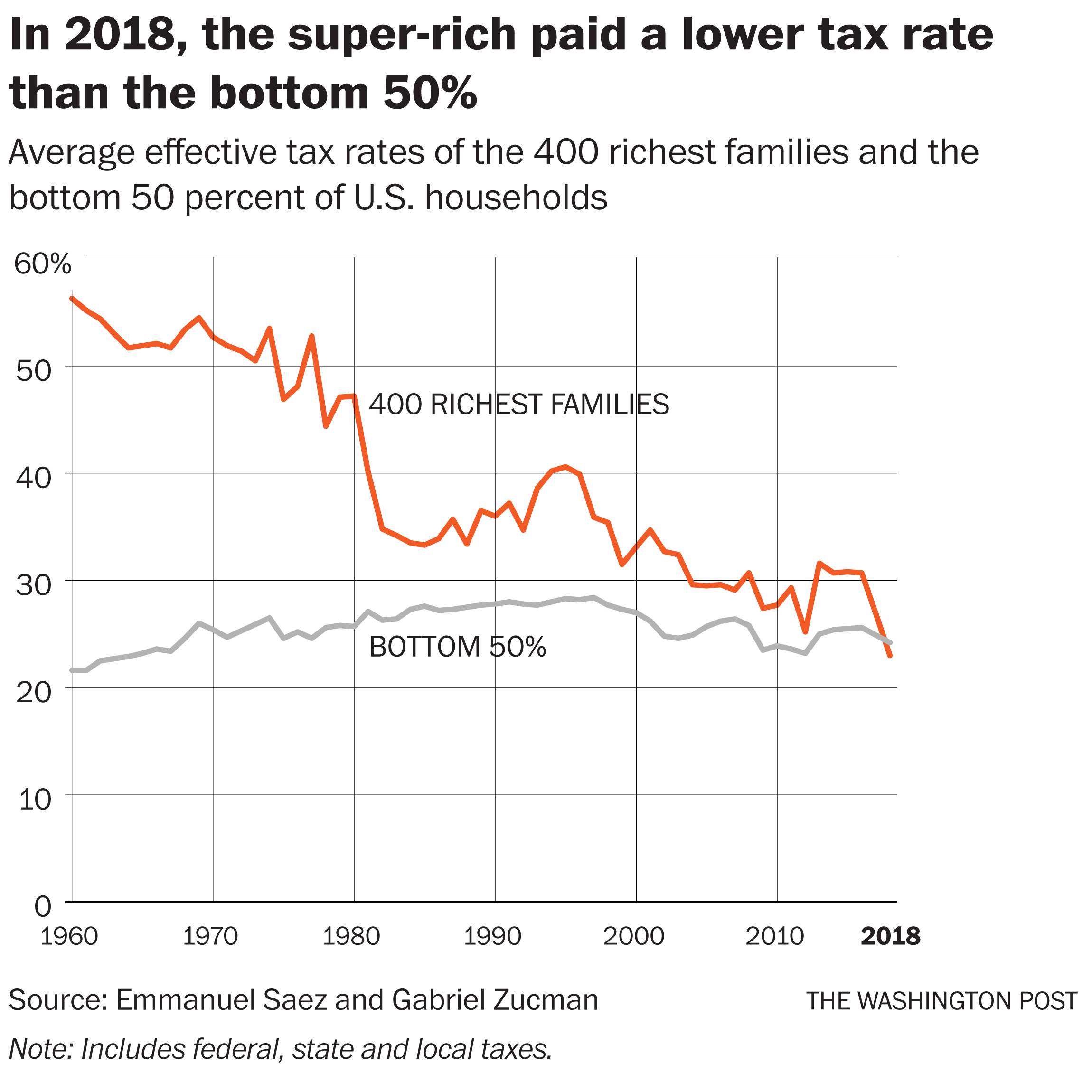

For The First Time In History U S Billionaires Paid A Lower Tax Rate Than The Working Class The Washington Post

American Taxes Are Unusually Progressive Government Spending Is Not The Economist

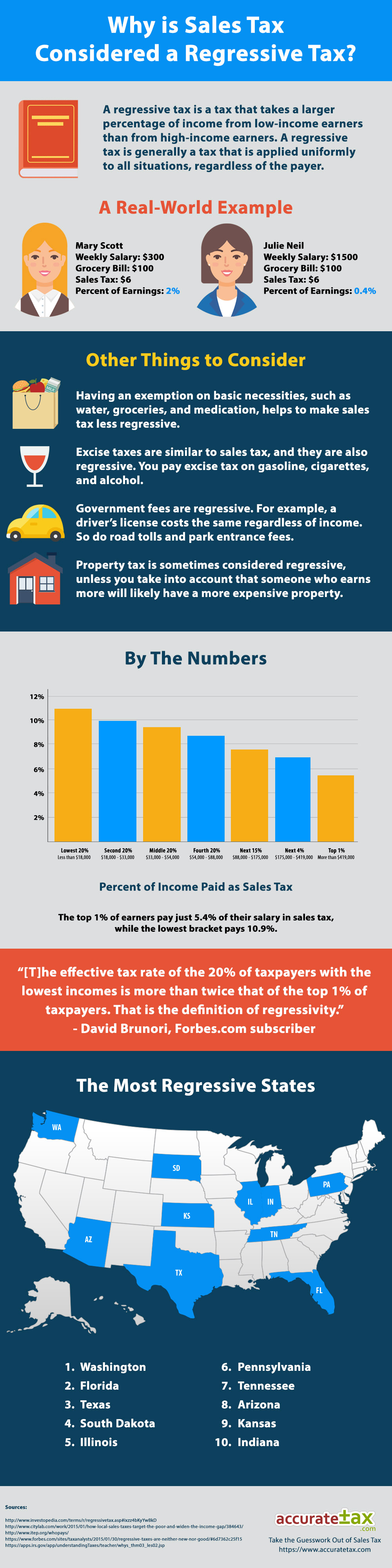

Why Is Sales Tax Considered Regressive Sales Tax Infographic

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

This Is A Whole Lesson On Elasticity With Its Main Activity Being The Elasticity Game Activity This Is A Fantastic Economics Lessons Activity Games Economics

Progressive And Regressive Taxation

Resourcesforhistoryteachers Progressive Proportional And Regressive Taxation

Taxation Principles Of Economics 2e

Understanding Progressive Regressive And Flat Taxes Turbotax Tax Tips Videos

Progressive Tax Economics Help

Brief Progressive And Regressive Taxes Austaxpolicy The Tax And Transfer Policy Blog

Tax Systems Progressive Regressive Proportional Economics Lessons Learning Objectives Economics

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Comments

Post a Comment